- Super User

- قاعدة البيانات المالية

Phase (1)

The Banks database contains data from Bank of Sudan aggregate balance sheet, income statement numbers from 2010 to 2014 of Sudanese Banks so the data was entered using the same code used by the Bank of Sudan for their aggregate report of Sudanese banks. Then a computing program was used in order to compute financial ratio which represent standard financial ratio which act as a bench mark for Sudanese banks and can use to compare with their own ratios. The standard financial ratios computedthen generated from the computer in form Diagrams.

Financial ratios

The classification chosen was the priori approach which is a simple grouping system that can be used to provide some structure to a set of financial ratios. This approach is used in most accounting text books. This bank data base use five main categories:

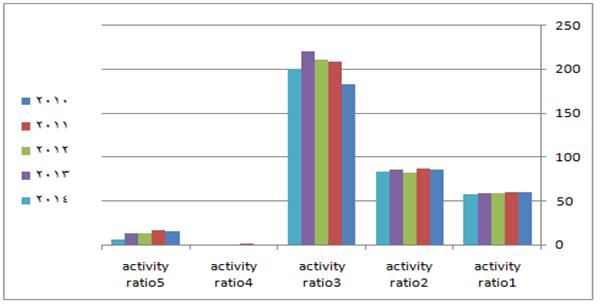

1- Activity ratios:

This ratios measure how efficiently and effectively the bank management manage the assets of the bank. There five ratios:

Ratio 1 = Asset turnover= total deposits/Total assets of the banks

Ratio 2 = Account receivable turnover=Total Finance granted by the bank/ total deposits

Ratio 3 =Total finance to Investment deposit= Total Finance granted by the bank/Investment deposits

Ratio 4 =Securities investment to Total Finance granted by the bank= Invest in securities/ Total Finance granted by the bank

Ratio 5= return on equity= Stockholder equity/ total liabilities

The following table shows the activity ratios from 2010 until 2014

| Asset turnover | Account receivable turnover | Total finance to Investment deposit | Securities investment to Total Finance | return on equity | |

| 2010 | 59.63854502 | 85.24220765 | 181.7954946 | 0.088752014 | 14.91757205 |

| 2011 | 59.73763741 | 85.9503822 | 207.4149312 | 0.710817035 | 15.34317614 |

| 2012 | 58.09575677 | 81.9636525 | 209.7435074 | 0.00785029 | 12.44923693 |

| 2013 | 58.29605273 | 84.82965662 | 219.1934993 | 0.02175099 | 12.96877467 |

| 2014 | 57.83638221 | 82.56758929 | 199.6356499 | 0.019114939 | 5.568911155 |

The chart below shows the comparison of the activity ratios from 2010 until 2014

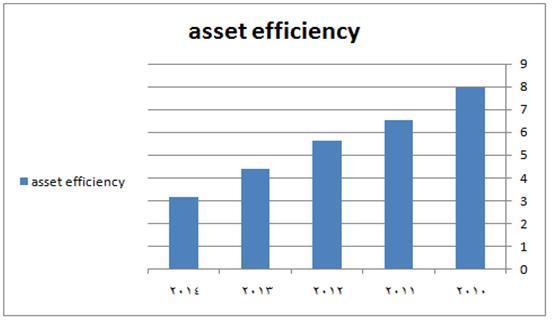

2- Efficiency ratios

These ratios measure the quality bank assets and how efficiently are used only one ratio was calculate this category is under study because it overlap with other categories or cannot be calculated because of the lack of data. There is only one ratio

Ratio = other debit\total assets

The following table shows the asset efficiency ratios from 2010 until 2014

| other debit\total assets | |

| 2010 | 7.956561018 |

| 2011 | 6.529716722 |

| 2012 | 5.647410081 |

| 2013 | 4.412849259 |

| 2014 | 3.159025096 |

The chart below shows the comparison of the asset efficiency ratios from 2010 until 2014

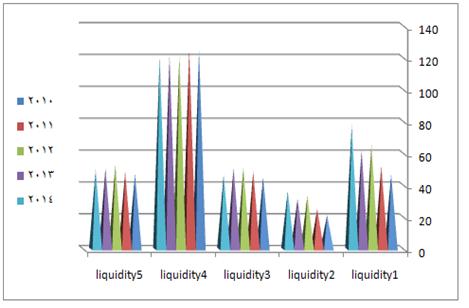

3- Liquidity ratios

Liquidity ratios measure the ability of bank to meet its short-term obligations toward deposit holder and other short term liabilities. The ability to pay current deposit withdrawals which is of concern to anyone who interacts with banks. The liquidity ratios look at aspects of the bank's assets and their relationship to current liabilities.

There 5 ratios

Ratio 1 Cash to current deposit = cash/Total current deposit

Ratio 2 cash to deposit = cash/ total deposit

Ratio 3 = Current deposit to total deposit= = Current deposit / total deposit

Ratio 4 Quick ratio = Cash+ marketable securities+ notes receivable+ Bank of Sudan account/Total current liabilities

Ratio 5 Current ratio = current assets /current liabilities

The following table shows the liquidity ratios from 2010 until 2014

| Cash to current deposit | cash to deposit | Current deposit to total deposit | Quick ratio | Current ratio | |

| 2010 | 46.94381 | 21.27098 | 45.31158 | 124.9144 | 47.16322 |

| 2011 | 52.15453 | 25.38991 | 48.68208 | 125.08 | 48.60829 |

| 2012 | 65.73972 | 33.55075 | 51.03573 | 121.7633 | 53.10048 |

| 2013 | 62.01966 | 31.59487 | 50.94331 | 121.4979 | 50.73784 |

| 2014 | 77.80413 | 36.39237 | 46.77434 | 120.9696 | 49.79154 |

The chart below shows the comparison of the liquidity ratios from 2010 until 2014

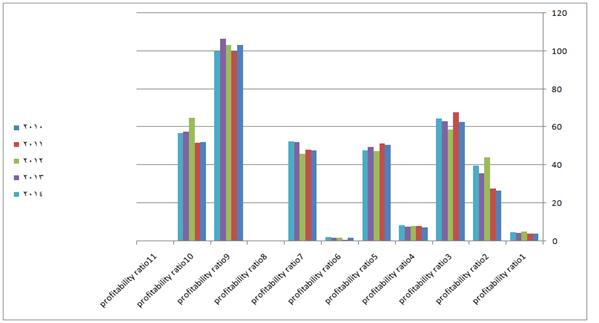

4- Profitability ratios

Profitability ratios are designed to evaluate the bank's ability to generate earnings.

Analysis of profit is of vital concern to stockholders since they derive revenue in the form of Dividends. Profits are also important to creditors because profits are one source of funds for debt coverage.. Furthermore Management uses profit as a performance measurement There are 11 ratios

Ratio 1 Return on assets= Income after tax /Average of total assets

Ratio 2 Return on equity=Income after tax/ average stockholder equity

Ratio 3 Finance income=Income from finance/total income

Ratio 4 Basic earning power= Income before Tax and Zakat/Total assets

Ratio 5Other debit to total assets = Other debit / total assets

Ratio 6 Provision for Finance risk = Provision for doubtful debit/net income

Ratio 7Expenses to revenue = Total expenses / total revenue

| Return on assets | Return on equity | Finance income | Basic earning power | Other debit to total assets | |

| 2010 | 3.847828968 | 26.49832353 | 62.57055045 | 7.386874728 | 50.83721239 |

| 2011 | 4.159434315 | 27.82362318 | 67.92286932 | 8.006064281 | 51.34472767 |

| 2012 | 5.2970224 | 44.08315349 | 58.62340287 | 8.144682445 | 47.55641559 |

| 2013 | 4.485923005 | 35.64690666 | 63.00243638 | 7.793852155 | 49.45234135 |

| 2014 | 4.692699388 | 39.72154949 | 64.56825799 | 8.24460533 | 47.75410652 |

Ratio 8 Efficiency indicator = Operating expenses/ Operating revenue

Ratio 9 Gross profit margin= Net operating profit/ Bank’s sharefrom finance and investment

Ratio 10Net profit margin = Net operating profit / total bank income

Ratio 11 Cost ratio = Total expenses /total revenues

The following table shows the profitability ratios from 2010 until 2014

| Provision for Finance risk | Expenses to revenue | Efficiency indicator | Gross profit margin | Net profit margin | Cost ratio |

| 1.887715876 | 47.90991983 | 0.265393083 | 103.3248541 | 52.09008017 | 0.015829304 |

| 0.632313149 | 48.04645368 | 0 | 100 | 51.95354632 | 0.017211949 |

| 1.968708003 | 46.11685398 | 0.294006595 | 103.1288861 | 65.03657369 | 0.02140813 |

| 1.737731864 | 52.2037412 | 0.286348075 | 106.4690762 | 57.55719913 | 0.018233438 |

| 2.019785941 | 52.4489561 | 0 | 100 | 56.91842363 | 0.012786354 |

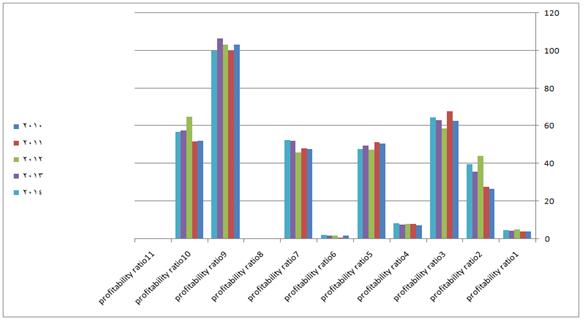

The chart below shows the comparison of the profitability ratios from 2010 until 2014

5- Debit ratios.

Viability and capital structure ratios measure a company’s ability to meet its obligations and how much of the company’s assets are financed with debt. They reveal the equity cushion that is available to absorb any losses that may occur. There are 6 ratios

Ratio 1 Debit to asset = Total liability/Total liabilities and stock holder equity

Ratio 2 Equity asset ratio = =Stockholder equity/Total liabilities and stock holder equity

Ratio 3 Debit to equity ratio =Liabilities/ Stockholder equity

Ratio 4 Equity to fixed assets= Stockholder equity/Fixed assets

Ratio 5 Liabilities to total assets= liabilities/total assets

Ratio 6 Equity of deposit= Stock holder equity/Total deposits

The following table shows the debt ratios from 2010 until 2014

| Debit to asset | Equity asset ratio | Debit to equity ratio | Equity to fixed assets | Liabilities to total assets | Equity of deposit | |

| 2010 | 85.07689706 | 17.5407231 | 570.1019247 | 334.0826945 | 2.850924449 | 24.34839406 |

| 2011 | 84.6501292 | 18.13331054 | 551.4712814 | 314.268606 | 3.06E-08 | 25.0249112 |

| 2012 | 87.57974379 | 14.18165397 | 705.1363702 | 283.2374444 | 2.39E-08 | 20.68305763 |

| 2013 | 87.09955112 | 14.81115426 | 675.1668253 | 248.6042413 | 2.63E-08 | 21.58692671 |

| 2014 | 94.45340193 | 5.872311591 | 1702.906912 | 229.4904444 | 7.29E-08 | 20.4265694 |

The chart below shows the comparison of the profitability ratios from 2010 until 2014

روابط ذات صلة

اتصل بنا

السودان - الخرطوم - شارع الجامعة - العنوان البريدي ص.ب 1880 الخرطوم

T: (00249) 155 - 144913

T2: (00249) 18377171600- 2491

F: (00249) 183780 - 913

E: crpc@sabfs.edu.sd